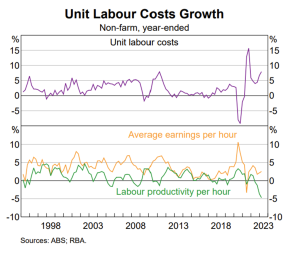

The world is seeing some radical changes. According to the Australian Bureau of Statistics, the last quarter marked the largest fall in productivity in Australia on record and rapidly accelerating wage growth.

(see Labour productivity per hour below).

And as we know this is not just an Australian problem, the US Bureau of Labor Statistics has released its 2023 first quarter Productivity and Costs report. The report found that labour productivity has decreased by 2.1% in the quarter while unit labour costs increased by 4.2%.

In the face of declining productivity growth, automation emerges as a powerful remedy for many industries including the Financial Services industry. It can empower employees to focus on more meaningful and strategic aspects of their roles, fostering innovation and creativity. The resulting increase in efficiency, accuracy, and resource optimisation helps reverse the negative productivity trends, ensuring a more resilient and successful future for the financial sector. With the burden of repetitive tasks lifted, professionals can redirect their efforts toward valuable endeavours, paving the way for a progressive and agile financial landscape.

Processes Primed for Automation:

The world of finance is brimming with opportunities to optimise efficiency and productivity through automation. Numerous tasks, spanning from the initial client onboarding and seamless invoice processing to customer service, as well as ensuring regulatory compliance, accurate performance reporting, and smooth billing management, can all be effectively streamlined. By embracing automation, financial institutions can not only reduce manual errors but also free up valuable time and resources, empowering them to focus on delivering top-notch services and making well-informed decisions for their clients’ benefit.

The automation demonstrated by Admin Assist in dealer statement processing and reconciliation serves as an excellent example of the type of automation that financial planners can embrace. The process involves the bot reading bank statements and utilising a secure password wallet to retrieve remuneration reports from dealer portals. It then automates the upload and reconciliation of the bank statement data with the dealer system, such as CommPay, ensuring meticulous verification of transactions and reducing the risk of errors. Any discrepancies that arise during the reconciliation process are promptly identified and directed to an exception folder for further review by financial planners. By adopting this type of automation, financial planners can streamline their operations, increase overall efficiency and accuracy, and allocate more time to focus on providing personalised financial advice, building stronger client relationships, and staying ahead in the rapidly evolving digital landscape. This, in turn, improves client satisfaction and positions financial planning firms for greater success in a competitive market.

Benefits of Automation:

Increased Efficiency:

Supercharge your team’s productivity with automation. By eliminating manual tasks like data entry and document generation, you can expedite workflows, reduce errors, and handle larger workloads. Work smarter, not harder, and deliver prompt responses to client needs.

Cost Savings:

Automation leads to substantial cost savings by reducing labour-intensive tasks and minimising human errors. By automating processes, you can optimise resource allocation, cut down on operational expenses, and achieve a higher return on investment. For smaller financial practices, these savings can have a significant impact on the bottom line, allowing you to allocate resources strategically and invest in growth initiatives.

Enhanced Accuracy and Compliance:

Automation ensures accuracy and compliance by adhering to predefined rules and regulations. With automated data validation, compliance checks, and reporting, you can minimise the risk of errors, maintain data integrity, and meet regulatory requirements with ease. This not only reduces the potential for compliance penalties but also builds trust with clients and stakeholders.

Improved Client Experience:

Automation enables a seamless and personalised client experience. By automating processes like client onboarding, you can deliver faster response times, accurate information, and personalised interactions. Automated invoice processing ensures timely and error-free billing, while automated financial reporting provides clients with real-time insights. This, in turn, fosters stronger client relationships, boosts satisfaction levels, and differentiates your financial practice from competitors.

Scalability and Growth:

Automation provides the scalability required for your financial practice to thrive. As your business expands, automated processes can handle increased volumes without compromising accuracy or efficiency. Whether you are onboarding new clients, managing growing portfolios, or expanding into new markets, automation ensures your operations can scale seamlessly, enabling you to seize new opportunities and drive sustainable growth.

Focus on Value-Added Tasks:

By automating repetitive and mundane tasks, you empower your team to focus on value-added activities. Your talented professionals can dedicate their time and expertise to strategic initiatives such as financial analysis, advisory services, and business development. Automation elevates the role of your team, unlocking their potential to drive innovation, provide insightful guidance to clients, and deliver exceptional value. This not only enhances client satisfaction but also positions your financial practice as a trusted advisor.

Our Admin Assist service is the ultimate solution for revolutionising financial practices through automation. With Admin Assist, financial planners can streamline administrative processes and focus on serving clients and growing their practices. By entrusting the management of automation to our expert team, practitioners can maximise efficiency and productivity. With a flexible pay-as-you-use model, Admin Assist ensures cost-effectiveness, allowing businesses to leverage automation without excessive expenses. Experience the transformative benefits of Admin Assist and unlock the full potential of your financial practice. Contact us today to learn more and embark on a journey of streamlined operations and unprecedented success.

Related articles

Odoo 17 new features

Introducing Odoo V16 – faster, smarter, and loaded with new features

How to Optimise Business Performance by Combining Operational and Financial Data?